3 | Interchange

Card Processing Charges Explained

Wherever you’re selling, credit and debit card transactions probably account for a large chunk of your payments. So it’s important to understand how you’re being charged. This article walks you through the components that make up your card processing fees and then deep-dive into the part that accounts for the highest proportion: Interchange.

Credit card processing comes with three fees:

Processing fee: Charged by your payment provider for processing the transaction

Card scheme fee: Charged by the card schemes for using their network

Interchange fee: Charged by the customer’s bank

When it comes to interchange, there are ways to bring your costs down.

These fees vary depending on the type of transaction, your location, and business model (to name but a few). It’s confusing, but it can have a significant impact on your bottom line. The good news is, when it comes to interchange fees, there are ways to bring your costs down. But that’s only the case if you’re billed in a way that tracks the interchange rates (this is called Interchange++ - more on that later).

What are interchange fees?

Interchange fees are agreed by card schemes (Visa/Mastercard/Amex etc.) but are paid to the issuing bank (or customer’s bank). They're usually the biggest expense when it comes to card processing. They're also the biggest headache. The structure and fees vary for each market, as do types of cards (consumer debit, commercial debit, pre-paid and so on). And they change all the time.

Traditionally, there was very little transparency into how these fees were calculated. Large businesses with a high volume of transactions could negotiate lower fees, while smaller businesses were forced to pay the full amount. Markets dominated by the large international card schemes were most vulnerable because businesses could hardly refuse to accept the payment methods used by the majority of their customers.

Fortunately, in recent years, efforts have been made to standardise interchange with stricter rules, the introduction of fee caps, and an overall improvement in transparency.

Below is a break-down of the fees caps across different regions:

Note: US credit is unregulated and US debit applies to regulated banks only. Fee caps only apply to consumer cards in the US and EU. And, in Mexico, caps depend on industry and some rates are negotiable.

What impacts how much you pay?

Drivers that impact interchange fees include: region, sales channel, card type, and business model. Understanding these factors allows you to optimise the process and get the best rates. For example:

It’s better to use a local acquirer where possible.

Local acquiring. Just like mobile roaming fees, transactions are generally cheaper if processed locally. So, it’s better to use a local acquirer where possible because this is the only way to benefit from local regulations and incentivised fees.

Interchange++: the transparent billing structure

Interchange++ is a pricing model that tracks the interchange rates. For example, the fees cap across Europe has been a huge benefit for businesses billed with Interchange++ because when interchange goes down the saving is passed to you. To quote the Interchange Fee Regulation: "The outcome the European Commission expects is that merchants should know, for each transaction, the amount of the [Merchant Service Charge] and the interchange fee and are therefore able to check if the benefit of the regulation has been passed to them." You can read the full article here.

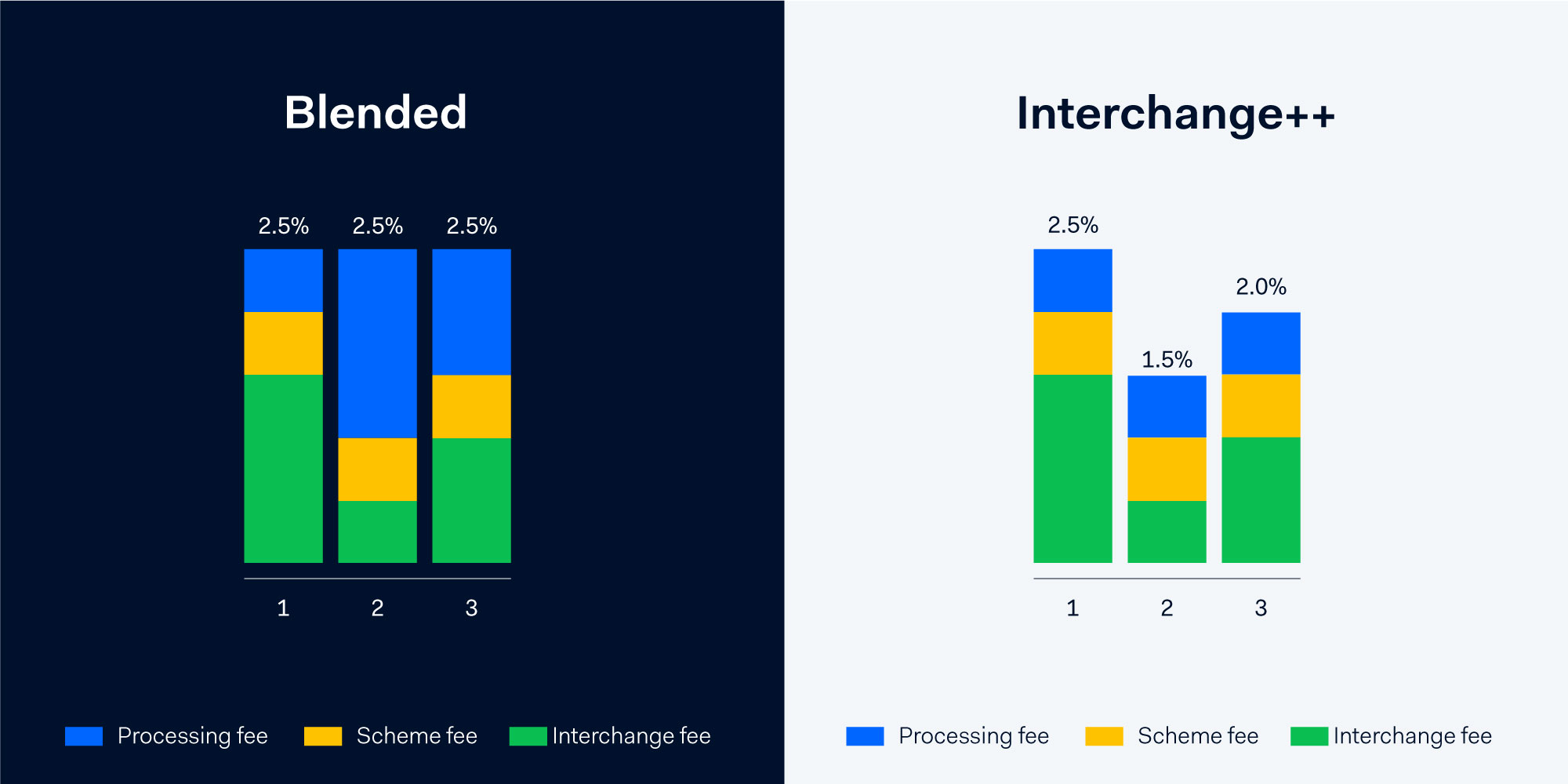

The alternative to Interchange++ is blended pricing as offered by companies like Stripe and Paypal. Blended charges an average processing cost plus a fixed markup. You’re charged the same price for every transaction, which makes it easy to understand but it’s not transparent. You can’t see what you’re being charged for and there’s no guarantee your processor will pass on any savings.

Blended vs Interchange++ pricing: When interchange goes down, your costs go down

You get to see exactly what you’re charged for every transaction so there’s no danger of hidden costs.

Incentivised rates

Interchange fees vary from market to market. In the US and Australia, for example, Visa and Mastercard grant lower rates to specific businesses like charities, travel agents, streaming services, and utilities. Again, you only benefit from this saving if you are billed using Interchange++.

We worry about interchange for you

You have better things to do with your time than track ever-changing interchange rates and regulations. So we do it for you. We’ll keep you informed about any changes that will affect you. Our dedicated team monitors rates and regulations to ensure you get the best deal. Plus, our local acquiring licenses in key markets around the world give you access to lower domestic rates.

Card processing transparency

Transparency is central to everything we do at Flowte, which is why you are always billed using Interchange++. You see exactly what you’re being charged and any savings we make for you are passed on at no extra cost.

Latest Published Interchange Rates:

We hope this has been helpful and cleared up any questions or confusion around interchange fees. Don’t hesitate to get in touch if you'd like to know more - we always love hearing from you.